Tips Pay for Your brand new Roof having No money (ten Roof Resource Possibilities)

One of the first issues residents keeps after they remember a roofing enterprise is in mention of how to buy a unique rooftop. You can find situations where your panels can’t be structured ahead, and therefore the brand new homeowner does not have any time for you to conserve for new rooftop, nevertheless they frantically you need a new you to definitely include their house. When you find yourself curious how to pay for a ceiling without money, there is solutions right here.

Substitution a threshold is among the higher priced do it yourself plans a resident performs, but it’s an important that once the roof handles the home and everything in they, away from lifestyle to property. If you’d like a new roof but can’t afford to invest for it initial, you can purchase what you would like now and you will pay for it over time which have capital. From inside the an ideal globe, resource cannot be required, in a few examples investment is the ideal provider.

Ideas on how to purchase your roof replacement for

Whether you’re planning a different rooftop later on otherwise out of the blue discover need you to definitely today, you must know how to pay money for rooftop substitute for content and you will work. Pricing is one of the ideal issues of every do-it-yourself business and you can roofing isn’t any various other, just like the cost of another rooftop ranges ranging from $8,five hundred and you will $20,000.

When you’re like most home owners, you don’t have several thousand dollars seated doing would love to become invested. Perhaps you have got a small down-payment readily available or maybe your have no dollars to pay now. Throughout these items, rooftop substitute for investment becomes the sole option.

Very first, you need to select a roof substitute for team that gives resource, but that’s only a portion of the troubleshooting you would like to consider, because you in addition need new specialist become a verified expert on their work, equipped to handle your homes roof replacement as opposed to procedure. Luckily for us, very reputable roofing designers provide investment choice that will match your means.

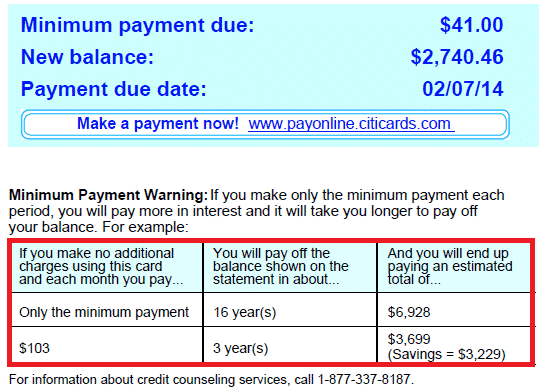

Other options to possess buying another rooftop were a house collateral loan, a home guarantee line of credit, a house update financing from the lender or if perhaps all else fails, credit cards to cover new roof. The original choices are essentially lower percentage funding financing, however, charge card payments might be sky-high, specific having an apr away from 29% or maybe more, so that may be the option when the everything else goes wrong.

Rooftop investment informed me

Your credit score/background could be a big determiner regarding exactly what roof construction money choice would be around. The newest terminology you have made would be a bit distinctive from what a friend, friend, next-door neighbor or performs colleague only in accordance with the variations in the credit history. Also, investment choices often differ each credit looks, which means your most useful roof funding choice won’t be found until you perform a number of look.

What is actually roof funding?

Roof funding is a convenient mortgage choice geared to residents and you can companies trying safeguards the costs from a different rooftop. Permits you to bequeath the purchase price over the years, reducing monetary filter systems. Such solutions are very different, with interest levels and you may words influenced by lenders. Having Lordship loans roof funding, you could on time address roof points, making sure the protection and you will security in your home from the issue.

Roof financial support terminology you need to know

While you are a new comer to roof funding, there’s particular words/terms and conditions you need to familiarize yourself with. Listed here are some of the principles to help allow you to get already been.

Apr stands for annual percentage rate. Annual percentage rate may differ in one debtor to the next, also from financier to another location. Annual percentage rate is largely just what financial charges you on mortgage. When comparing that capital solution to a separate, one of the most important elements was Apr.