Can you imagine I own my belongings downright?

Most banking institutions will demand which you have at least 20% equity on tough costs of entire belongings/family package if it is every told you and done in order so you can offer the financing. How much does this suggest?

Can you imagine the latest house you would like can cost you $31,000, and you will family will cost $170,000 to create. In cases like this, you would have to offer a funds downpayment equal to 20% of one’s difficult price of structure (residential property cost + home pricing) so you can safe which build loan. Thus $two hundred,000 X 20% means $forty,000 cash needed.

Crucial Note:

You can find banking institutions that can perform design fund to own as little due to the fact 4% down! However, you should just remember that , after you lay lower than 20% upon your loan, you will have to spend Personal Mortgage Insurance (PMI). PMI is normally .5% to one% of one’s financing harmony a-year. If you has a $100,000 mortgage additionally the PMI is actually 1% a-year, you will have to pay $step 1,000 per year near the top of the normal loan costs, assets taxation, Pennsylvania installment loans and you can home insurance. This $1,000 is frequently split and you will paid off on a monthly basis.

For people who individual your land and don’t are obligated to pay some thing into the it, oftentimes the financial institution gives you credit into the property value your property. Therefore if the homes appraises at the $20,000 plus the household you want costs $80,000 (to have a whole tough cost of $100,000) then your land was from sufficient worth to cover your own down payment, as 20% off 100,000 is actually $20,000, plus residential property is already worth $20,000.

How to rating a separate financing come?

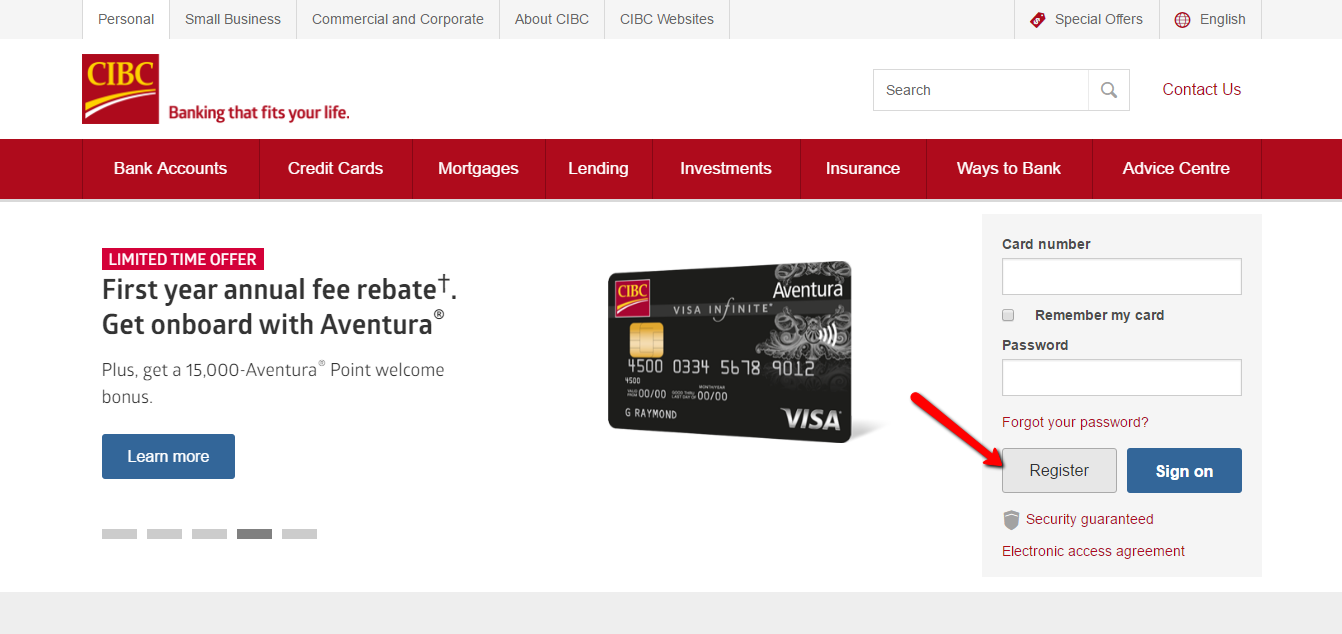

When obtaining a casing mortgage regarding a lender, almost everything begins with the new pre-acceptance. Immediately after the 1st meeting, the financial institution commonly require taxation statements, earnings statements, papers on existing obligations that you have, and possess focus on their borrowing so you’re able to determine how much he or she is ready to financing you. So long as everything you looks good they’re going to give you an excellent loan pre-approval.

Armed with an effective pre-approval amount, anybody can begin to search for residential property and discover a builder who’ll generate your a house within your budget. After you discover the land and also have a quote out of your creator, your gather this particular article and you can fill out they towards the lender to possess latest approval.

The lending company have a tendency to review the documentation and you may buy an appraisal to dictate the long run worth of the home. Immediately following that which you checks out, the lending company often completed something to their prevent. The will would like you to own at least 20% security in the offer. I after that schedule an initial date for your design mortgage.

Exactly what are design loan draws?

During the period of construction, your creator becomes funds from the lending company within the brings. A blow try an amount of money given out by lender to purchase ongoing will cost you out of design. The initial mark generally speaking covers the purchase of land. Your own creator will you want occasional draws to cover his rates to construct your home. There is certainly generally speaking a draw to afford basis and you may webpages cleaning costs. You can also have a draw for the better and you will septic program, and you may a suck to your driveway or any other outbuildings.

When you improve last draw, your own creator is going to do a final go-as a result of of the property with you. This enables these to look after one bits and pieces particular items you could find. When you sign off toward household and all sorts of final inspections are complete, you get your own Certificate away from Occupancy regarding the local building service. Almost there!