Ambac and additionally integrated a claim out of replacement and you can vicarious liability up against Bank away from America

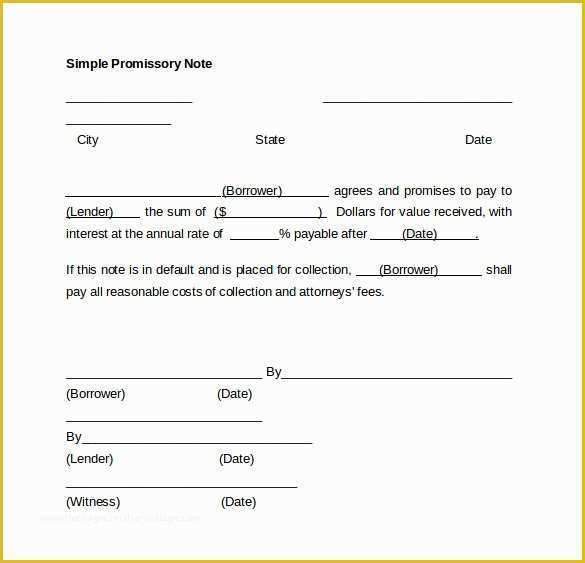

Area 3.03 (c) of your Insurance rates Preparations provides one Countrywide agrees in order to reimburse Ambac having “charges, fees, can cost you, and you can expenditures . . . also practical attorneys’ . . . fees and expenses, regarding the . . . the fresh administration, coverage or maintenance of every rights according of every off new Surgical Data files, in addition to defending, keeping track of, or engaging in one litigation or proceeding according to any one of brand new Operative Files.” Part 5.02 (b) of your Insurance rates Arrangements will bring that, “except if if you don’t expressly considering, zero remedy here conferred otherwise reserved is intended to be private of every almost every other readily available remedy, but for each option should be collective and you can should be simultaneously for other cures given below which Insurance policies Contract . . . otherwise present at legislation or even in guarantee.”

For the bac began the minute action, alleging you to definitely Countrywide “fraudulently triggered Ambac to add borrowing from the bank enhancement to change this new marketability of one’s notes and certificates granted concerning the each one of new RMBS securitizations

By 2007, on the housing marketplace into the refuse, financial default and you will delinquency costs enhanced (come across Federal Construction Finance Agency, 873 F3d in the 106-107). Consequently, Ambac needed to spend way more claims than forecast. Ambac up coming initiated brand new repurchase process by submitting notices away from violation so you’re able to Nationwide.

Up until now, the newest complaint alleges, Ambac started initially to opinion the fresh new origination documents out-of defaulting loans and you can discovered that approximately eight,900 away from 8,800 that have been reviewed contains material breaches of your Insurance Agreements’ representations and you can guarantees

” While doing so, Ambac so-called situation violation of each Insurance coverage Arrangement; infraction of one’s representations and you can warranties amongst the parties; breach of your repurchase process; and indemnification and reimbursement regarding attorneys’ charge and you may expenditures.

Both sides went to have limited conclusion judgment. Due to the fact highly relevant to this attention, Best Legal computed, relying on Insurance coverage Laws 3105, you to Ambac did not must have indicated justifiable dependency and you can losses causation to make it into the fake incentive claim. When it comes to Ambac’s claims alleging breaches of the numerous contractual representations and you can warranties, the new courtroom learned that really the only solution supply don’t pertain “beyond Point 2.01 (l),” so “towards the total amount you to Ambac can prove breaches of other parts of your own I[nsurance] Arrangements, it is not limited by the only real answer regarding repurchase.” Although not, brand new legal figured, “on the the total amount that Ambac is actually entitled to discover a honor away from injuries not related into repurchase process,” Ambac was not eligible to recover the payments built to dealers pursuant into Insurance coverage Preparations since compensatory damages for the reason that it manage feel “efficiently comparable to rescissory damages,” and this any damage calculation “have to be determined for the regard to states costs generated on account of loans breaching” representations and you will warranties. Finally, the latest legal found that Ambac was not eligible to get well attorneys’ costs.

On the focus, the newest Appellate Office altered Finest Court’s view simply and you may affirmed (Ambac Guarantee Corp. v Nationwide Mortgage brokers, 151 AD3d 83 [1st Dept 2017]). The fresh new Appellate Department held that justifiable dependency and you can loss causation is called for areas of a deceptive bonus allege, and this Insurance coverage Rules 3105 isnt relevant to help you a familiar laws scam allege having money problems. The fresh Appellate Section refused Finest Court’s holding the repurchase protocol was not the only fix for Ambac’s says having breach out of representations and you will warranties, holding as an alternative you to definitely “Ambac you should never prevent the outcomes of your best remedy supply by relying on exactly what it words transaction-level’ representations, while the cardio out-of Ambac’s suit is that it absolutely was harm due to a large number of defective fund.” The newest Appellate Office verified Supreme Court’s types of damage formula getting one says perhaps not subject to new repurchase process, carrying one Ambac wasn’t eligible to compensatory injuries “amounting to any https://elitecashadvance.com/installment-loans-or/oakland/ or all states costs they generated otherwise makes below the new formula, no matter whether it arise away from a breach otherwise misrepresentation.” Finally, the fresh new Appellate Office confirmed Best Court’s carrying one to Ambac wasn’t permitted attorneys’ charge. This new Appellate Department offered Ambac get off so you’re able to desire.