Short-term ways to connection the fresh pit up until long lasting funding will get readily available

A painful currency mortgage, known as a bridge financing, was typically accustomed loans new acquisitions away from assets, developments, and renovations, otherwise as a preliminary-term service for real property traders to stabilize book.

Such financing lets consumers to help you link the fresh new pit during the times when investment required yet not yet , offered. Private money interest rates dont fluctuate such organization fund you to definitely try associated with well-known attract indices.

Each other firms and other people can enjoy tough currency finance at Titan Financing we could modify this type of funds for the majority of additional items.

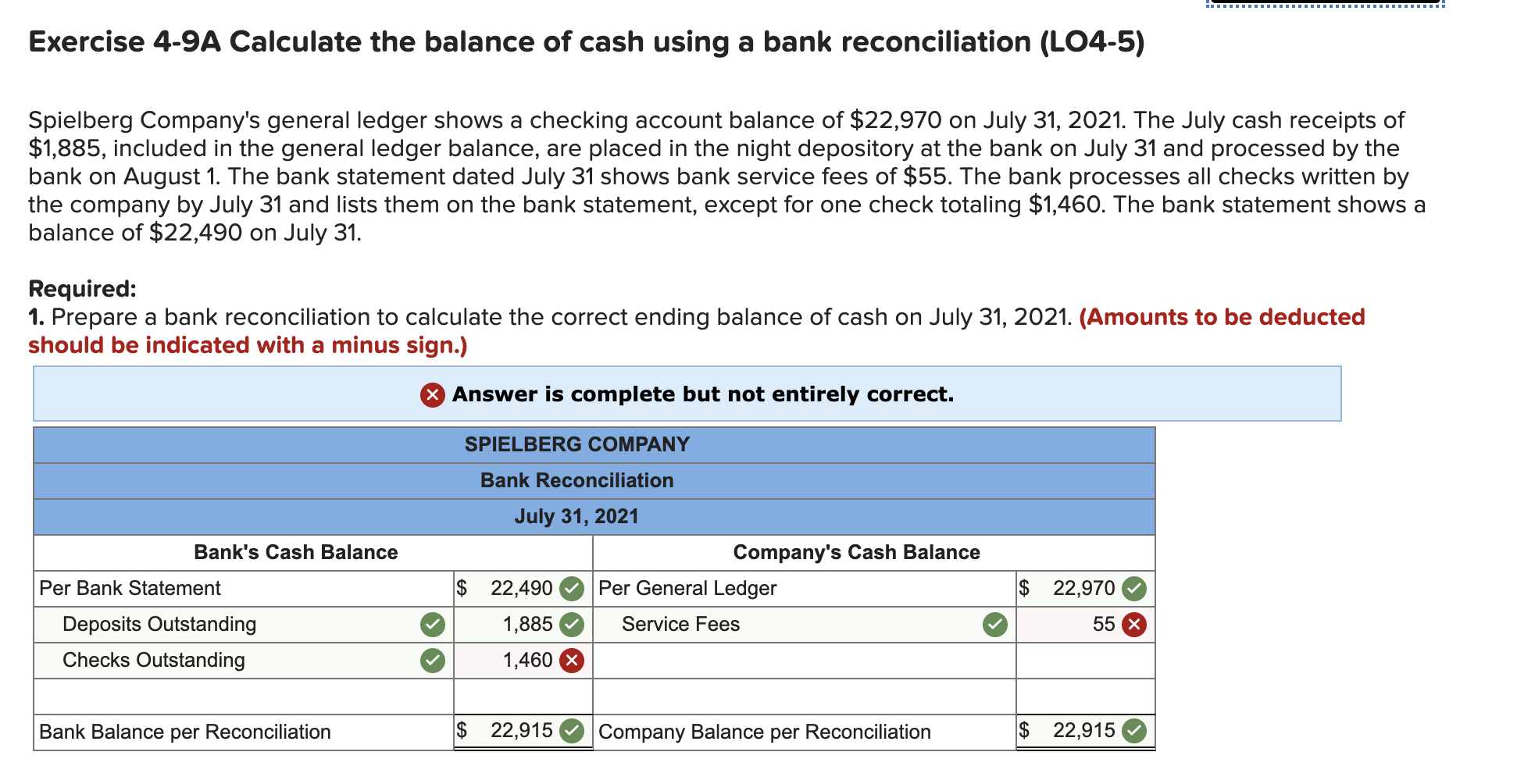

When are difficult Currency Money a good fit?

- To 100% LTV on the a deal with mix guarantee

- Assets reposition and cost incorporate circumstance

- You need to personal quick when deciding to take benefit of the opportunity

- Your credit rating try less than antique bank assistance

- Need to File up-to-date taxation statements to ensure updated rents or profits

- Good judgment underwriting

- Loan size $100K-$5.0 MM

- Financing identity 1-three years

If you are considering a difficult money loan to capture on the second venture or processes, Titan Capital will be here to help make the procedure possible for you knowing. If you are not sure just what a hard currency financing involves, here’s a simple report on what it is and just why it might possibly be recommended for your requirements.

What’s a hard money loan?

A difficult currency mortgage is a type of bridge financing you to you need to use to find otherwise refinance a home. This type of finance may also be used getting methods such as house improvements and you can home improvements. These types of mortgage is investment-created, meaning its supported by items like a property as opposed to your credit score and you can background.

Individual lenders (unlike banking companies) normally point tough money finance. Good individual financial, such as for instance Titan Funding, will also make you a routine rate of interest on the mortgage in the place of a variable price. A fixed interest makes you bundle to come because you know exactly your balance and you can what all month’s commission will end up being. When you are because of a reputable tough loan provider, you might others smoother understanding indeed there will never be shocks across the way.

Whenever would a challenging currency loan getting beneficial?

Truth be https://paydayloansconnecticut.com/mystic/ told there a many reason you could potentially look for a good tough currency mortgage. Probably one of the most prominent reasons ‘s the price from which you could get these types of mortgage. Other styles of investment can take weeks are acknowledged and after that granted; although not, acquiring a difficult money loan are an instant processes, commonly trying to find its method into the pocket in 2 weeks otherwise smaller after you might be acknowledged.

Hard currency lenders can sometimes not take your credit rating to your account whenever researching you for a financial loan. Just like the loan was house-created, the funds is safe having real property. For those who have a minimal credit history but can right back brand new financing with an actual physical advantage, a hard currency mortgage will be a good option. Certain reasons you could potentially prefer a challenging currency financing is:

- You can not confirm income. Once you know you’ve got an established earnings, you cannot confirm they in order to conventional loan providers, you should use your property and you may a residential property showing one you can afford when deciding to take the mortgage.

- You may be household-turning otherwise have to redesign. You could potentially inform you an exclusive money-lender you individual the latest possessions so you can to get money to change you to definitely possessions. If you are searching to help you remodel then sell their a home, an arduous money mortgage should be a quick way to flip property.