Va Financing having Experts having Damaged Borrowing from the bank

Credit Criteria

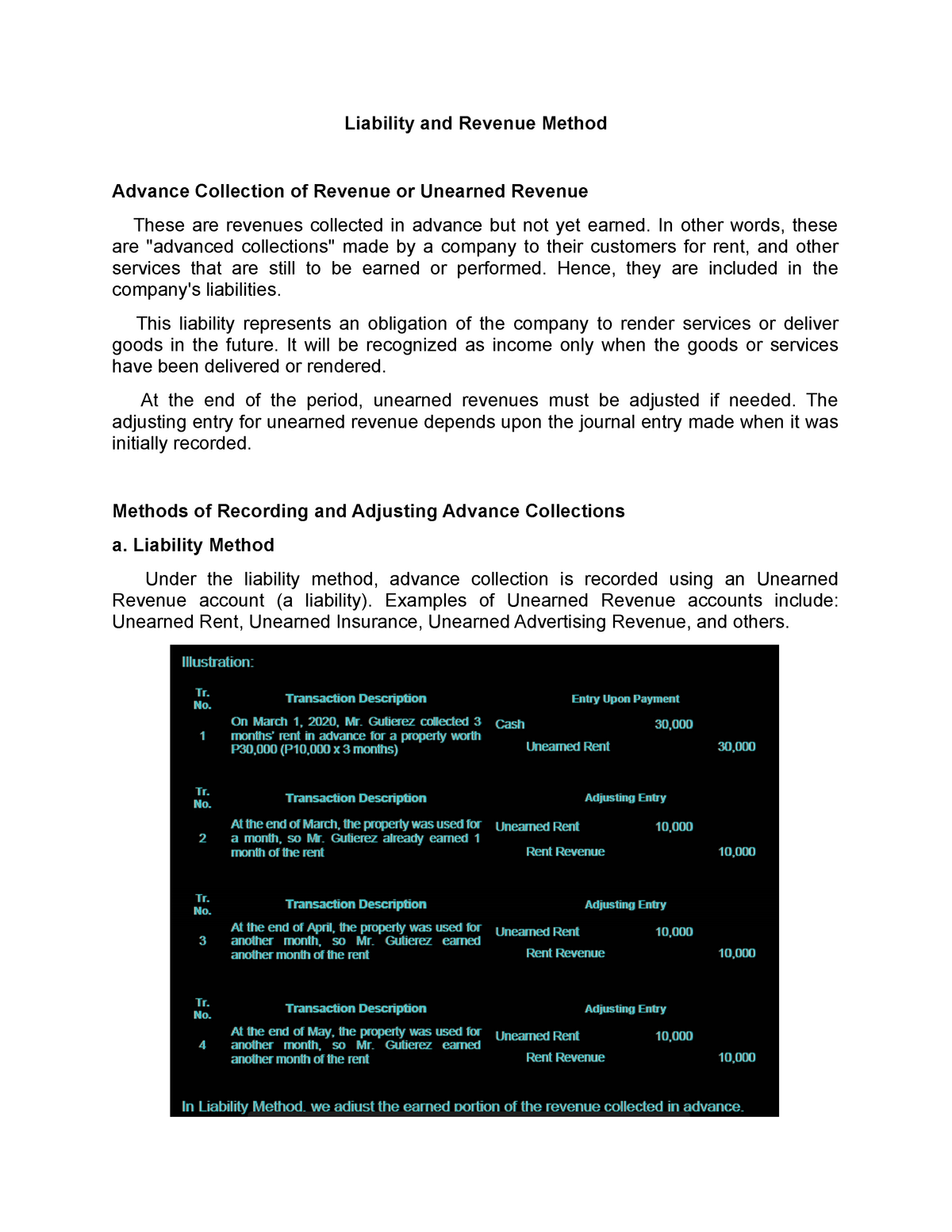

One of the largest advantages of this new Va Loan is that the latest Institution away from Veterans Issues has no people borrowing requirements. Without a requirement set because of the bodies, lenders are able to be a whole lot more versatile and regularly take on all the way down fico scores than just traditional financial issues. Due to the fact Va does not have any a minimum needed get they do possess requirements you to definitely rotate up to a pros creditworthiness. This type of conditions mainly focus on a pros newest several to help you 24 months out of payment records.

In the event that a veteran can show they have zero later costs on their credit report during the last 1 year and can prove couple of years from timely houses money (book or home loan) they generally would be eligible to pick a house making use of their Va financial work with.

On MHS Financing, not only is our borrowing from the bank conditions a lot more flexible to own Virtual assistant Funds than many other loan facts, but i also offer Virtual assistant Finance getting veterans which have busted credit. Broken borrowing Va Riverside loans money are created to offer next possibility to own pros and energetic solution people who’ve borrowing from the bank or debt-to-income ratio situations. Because the you will find zero financial overlays, we can let customers which ordinarily have a difficult date delivering an effective Virtual assistant Financing. Quite a few readers write to us that we had been the sole business that will make them recognized to shop for property. In the past, we now have actually managed to assist members with sub five hundred borrowing ratings fool around with their hard earned Va financial work for.

With of the finest interest rates available and you will a laid back credit rating requirements, Va Fund might be a robust unit getting armed forces group who are looking to get yet another home.

Loans So you can Income Ratio

Including zero credit score requirements, loan providers just who point Virtual assistant Finance are able to provide much more liberty regarding debt-to-money (DTI) ratio requirements. DTI ‘s the part of their terrible monthly income one goes into the and make month-to-month loans payments. Generally, lenders and you can underwriters commonly evaluate exactly how much you borrowed from monthly so you’re able to the amount of money you earn.

Whilst the Va doesn’t always have good mandate if this relates to a max DTI ratio, there are many direction that all loan providers pursue where consumers are motivated to provides a good DTI proportion less than 41%. MHS Financing, for instance the Va in itself, doesn’t have DTI proportion conditions. Really lenders tend to be more critical regarding Virtual assistant loans that have a great DTI significantly more than 41%. MHS Credit believes this can set way too many stress on an experienced and his awesome otherwise their own household members whenever domestic hunting and cannot membership to other money in the house that cannot be employed to meet the requirements.

Calculating Their DTI

When you’re wanting calculating their DTI, there is certainly a simple formula in order to take action. First, complete your month-to-month expenditures that would be on your own credit history together with car money, student education loans, and child care expenditures. Add some one on the suggested monthly casing commission to get a complete month-to-month financial obligation amount. 2nd, make sense all your monthly earnings along with regular (2+ season records) self-employment income and you may split that overall by your overall monthly financial obligation to really get your DTI.

Keep in mind that maybe not everything could be factored into your monthly earnings otherwise monthly debts. Like, for those who have almost every other income including self-employment money otherwise overtime, you will likely need to promote at least a two-season record regarding to qualify. Additionally, most loan providers does not count cell phone costs, insurance costs, household items, and you can goods as part of your monthly bills.