Home loan Paperwork Options for Worry about-Working, 1099 Teams, and Low-Conventional Earnings Earners

After you get a home loan, we have to file which you have sufficient income to repay the bucks you are borrowing from the bank. While care about-functioning and your money is problematic to help you document, there are feasible mortgage apps that do not require conventional income tax come back data files.

Prior to now, you really have read words including zero-doc money; no income verification mortgage loans; and you will said earnings funds: which is misnomers of the the current standards. They certainly were the newest apps that triggered the fresh 2007 and you will 2008 thread business and you can a property freeze. The present financial selection is a great deal more consumer protections and are usually a great deal more correctly called Alternative Files Financing Software or no Taxation Return Financial Apps.

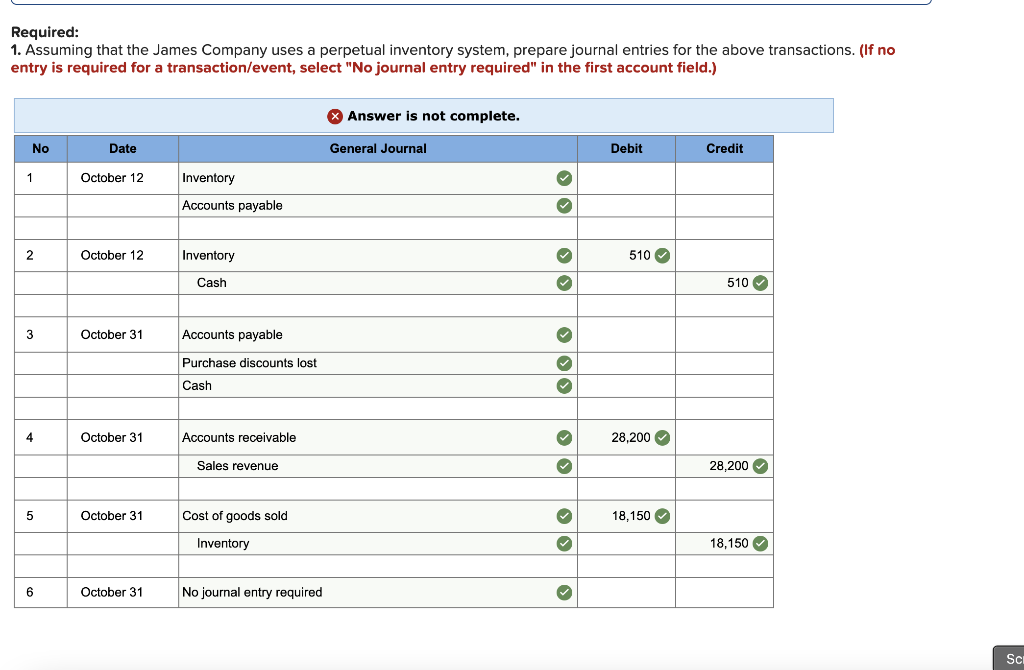

Zero Tax Get back Home loan Software

Let us feel obvious, even though you don’t have to make a tax get back, does not mean you’re not documenting your earnings. Rather than tax statements, you happen to be taking financial statements, asset comments otherwise 1099s to display income along with your element to blow straight back the cash youre credit. You need to have a good credit rating off 680 or higher. Let us dig a tiny better….

Lender Declaration Mortgages

These types of programs can handle notice-working borrowers by allowing using financial comments in place away from tax returns. Who’s an informed match: Self-operating home buyers which manage almost all their company income due to their providers bank statements in order to without difficulty tune its dumps.

We normally gather and you will review new dumps toward 12 to 24 weeks of personal and you can/or organization financial comments, to determine finances-disperse. This put background records the qualifying income and you can capability to pay straight back the total amount youre borrowing.

1099 Mortgage loans

Borrowers that happen to be separate contractors, freelancers, if not mind-in the concert discount may be a great fit to have 1099 Mortgage loans while they generally found 1099 comments using their website subscribers/employers. We’re going to fool around with 1099s rather than taxation statements. We normally gather and you can feedback several so you can 2 years away from 1099s to determine your qualifying income and your capability to pay off the total amount youre borrowing.

Resource Qualifier Mortgage loans

This program is the best for homebuyers who don’t have enough old-fashioned earnings to meet the requirements but have loads of offers and expenditures that may be changed into month-to-month earnings.

More tech title are an asset Destruction Financing. Maybe you’ve a high internet worthy of but no work. Maybe you are resigned. Having an asset Qualifier Home loan, i explore a share of the savings and funding levels just like the a potential income source so you can qualify. Here is a good example: When you have $step 1,000,000 in assets and then we separate because of the 240 few days (two decades), that is $cuatro,166 four weeks which you can use so you can meet the requirements you having a home loan. Note: the internet property use to be considered try smaller money required to close off.

If you possess the called for income/ cash-circulate to settle the quantity you are credit, then mortgage is just as safer given that recording your earnings which have a classic tax get back. No matter how your file your application for the loan, it’s important to tell the truth along with your app very all of our underwriters can also be assess your own official certification precisely.

Simply Resource Qualifier home loan programs don’t require income. Obviously, you will have to document you really have a premier web really worth so you’re able to mark facing more a lengthy time frame.

americash loans locations Chimney Point downtown

No-income confirmation without-doc financing has actually good deservingly bad reputation of adding to the 2008 a house s usually do not exist the way they used to. The present financial choice were so much more user defenses and are a whole lot more accurately titled Alternative Records Loan Apps if any Taxation Go back Home loan Programs.

When you get paid-in cash and you may put the latest said dollars into your organization bank account, then you can utilize the bank statements in order to file your earnings. You’ll want to make sure the current presence of your organization having from the the very least a couple of years.

There isn’t any minimal income specifications to be a homeowner. You will want to promote documents that you have sufficient income in order to have the ability to repay the amount you are borrowing.

Most of the program features its own credit history conditions. Into the several of our very own government applications you can get a credit score as little as 600. Toward alternative paperwork financing applications, you ought to have a minimum a beneficial 660 center FICO get.

Will you be worry about-functioning and trying to puzzle out how to be considered having a home loan? They starts with a phone talk to talk about debt details. From there, we are going to determine what your better mortgage system alternatives will be and you can exactly how much domestic you could be eligible for. When you’re prepared to mention home loan certification, simply email address me to arranged a call.