Our very own Writings Puts You about Driver’s Seat

Permitting users as you get to the monetary desires is i create, that is why we’re equipping you with this pro belief, information, and you can pointers to help you get around.

- Financial Issues

- Home buying Solutions

- Lifestyle & Domestic

- Re-finance Options

- APM Insider

Cash-away re-finance

Brand new financing will pay off the first home loan, while the left loans will pay of debt. The financial institution usually sometimes shell out you to financial obligation in direct a swelling sum otherwise provide the borrower the cash to pay it well themselves.

Even if your interest rate in your home loan is actually lowest, this package could save you morebining high changeable interest debt toward you to fixed-price percentage could save you money every month. It can also save some costs in the end.

Price and you will label re-finance

A speeds and you will title re-finance is really what it may sound for example. The fresh financing comes with a lowered interest rate and a good longer term, perhaps even starting more than with a brand new 29-seasons financial.

This might be a terrific way to combat highest rates of interest, particularly when people prices have really made it difficult for that build your month-to-month mortgage payments.

You can then utilize the more funds you’re not using into the mortgage repayment to simply help lower their a good financing amounts from the highest-appeal credit cards, scientific expense, or any other mortgage stability.

Household guarantee credit line (HELOC)

Good HELOC allows you to borrow against new equity on your own household without changing the rate and you may label of your latest mortgage. This is certainly a very good idea for those who finalized your loan at the a price but nonetheless need certainly to accessibility your equity.

You are able to the amount your acquire for some something, eg renovations otherwise paying down higher focus debt. A HELOC functions in a different way out of a frequent financial where your pay only since you make use of it.

The many benefits of Refinancing

There are several huge professionals once you refinance their mortgage. You could pay-off higher-attract loans, tend to in a shorter time period. Your credit rating will additionally benefit, possible develop as your financial obligation shrinks.

You may want to put the currency you save together with your the new down rate of interest towards the debt payment operate. This enables one to pay-off these types of mortgage balance faster.

One of the greatest benefits to slamming down that it debt try the reality that it does make you some breathing area. Consolidating debt reveals the credit cards backup, delivering a cushion in case there are emergencies.

Speaking of issues, you can even make use of the money you happen to be rescuing per month to build-up their wet-day finance. In that way there’ll be cash on hand for big requests and won’t need certainly to have confidence in playing cards in the first lay.

And you will why don’t we keep in mind on comfort. All amount borrowed have yet another deadline, interest rate, and you may harmony. Because of the combining your debt, you can make clear the entire process of expenses it off. You will find one percentage during the mortgage that is way more good than highest-focus handmade cards.

Points to consider Before you Refinance

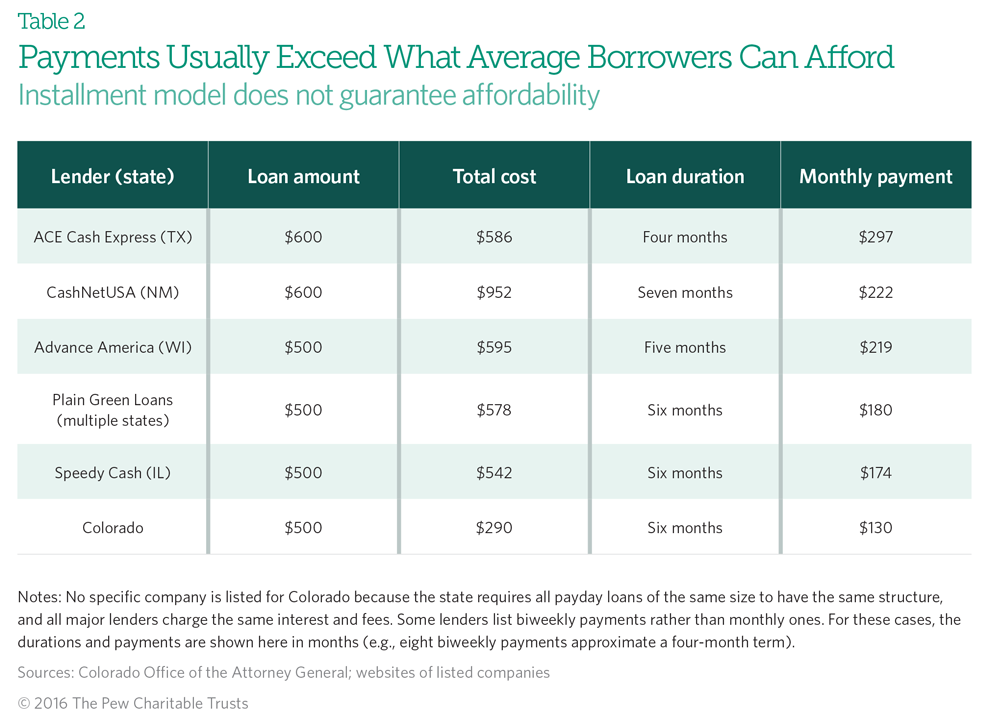

Obviously, as the you will end up borrowing more than your financial balance, your own monthly mortgage payments might be high. Whenever you are considering the pros and you may disadvantages regarding debt consolidation reduction refinance, think of it that way: Sure, their monthly mortgage repayments will be highest, often by the a hundred or so cash. But with less interest rate and simply you to definitely fee in order to create, new deals is also provide more benefits than the purchase price.

However, you really need to make sure that is a payment per month you are able. A debt negotiation financing will even indicate you are investing far more mortgage appeal along side life of the loan. However,, once more, you have got to weighing you to against your own higher-interest handmade cards. Therefore don’t subtract financial interest linked with the almost every other the expenses.

Another thing to think is where much time you intend to help you stay-in your home. A debt settlement re-finance tends to make sense should you decide so you’re able to stay for a while. In case you’re not, you will have smaller guarantee of your property if you decide so you can promote, meaning that less of your budget in your pocket.

The brand new mortgage are to have a 30- or 15-season payment period, very you need to make sure you are confident with its terminology.

A money-away re-finance and includes costs. Settlement costs usually normally add up to between dos% and you may six% of your own mortgage.

When you are thought pulling equity from your own home so you’re able to incentives high focus debt, click on this link for some info and you will issues should think about first.

If you find yourself enduring setting up loans while own property, today may be the time for you to place your domestic security to help you be right for you. Debt consolidation can help you pay down high-interest playing cards, medical expenses, or https://simplycashadvance.net/payday-loans-vt/ other mortgage stability and gives monetary recovery now.

If you would like in order to connect having a keen APM Financing Coach close by to examine the options, click on this link .