Have there been protected do-it-yourself funds to have poor credit?

Specific zero-credit-look at lenders be much more legitimate as opposed to others, even if. You can easily Funds, for example, has APRs to 200%, nevertheless also provides 29-date forbearance alternatives for folks who stumble on fee affairs.

How-to change your credit rating

Renovations aside, dealing with your credit rating is wise no matter what an immediate dependence on borrowing from the bank. It will enables you to benefit from greatest costs and terms, and build investment instructions otherwise tactics a lot more under control and you will affordable.

If you’re able to slow down your property advancements for a few weeks, you may be able to raise your credit history enough to change your likelihood of approval and you may less interest rate.

- Request and you can opinion a duplicate of one’s credit report, guaranteeing all of the data is appropriate and you may contesting whatever seems incorrect otherwise incorrect.

- Spend your own costs punctually, whenever.

- Decrease your borrowing application by paying off loans.

- Use playing cards responsibly. Credit cards is also alter your credit because of the increasing the complete borrowing from the bank supply, however, on condition that you keep your stability lowest and you will pay with the go out.

Generally speaking when anyone make reference to secured financing if you have crappy borrowing, it explore payday loans or title finance. These different financing is going to be unsafe, and now we dont recommend using them.

That is because they are available having heavens-large interest levels-have a tendency to multiple-digit-and want you to fool around with valuable tips such as your income or vehicle once the collateral.

For those who have bad credit, are apprehensive about your recognition odds with a classic bank are clear. not, it’s not value further jeopardizing debt safety. Just before turning to guaranteed-recognition fund, mention the options which have loan providers offering more modest conditions.

Should i get back home upgrade financing having poor credit no guarantee?

Do-it-yourself money is unsecured signature loans and do not want the house guarantee given that collateral. Since home improvements aren’t protected, bringing approved utilizes other variables, like your credit rating, loans, income, and you may loan amount.

Exactly what credit history do i need to score a house improve financing?

Of numerous lenders try not to establish at least credit rating however, high light that financial obligation, money, credit history, and you may loan amount Hobson loans are essential on the credit algorithms.

Upstart, such as for example, doesn’t county the absolute minimum score. Inform allows score as a result of 560, and Reputable has the benefit of financing for borrowers which have 550 scores and you can above.

How much can i obtain for property improvement financing?

Each financial has actually novel financing standards getting acceptance. You can fundamentally borrow doing your debt-to-earnings ratio (DTI) usually manage your, around the new lender’s limit.

Particular loan providers cap the financing amounts, irrespective of good borrower’s borrowing from the bank reputation and DTI. If you want a larger home improvement mortgage, prioritize loan providers which have larger limit fund otherwise browse Reputable for lenders that have large loan restrictions.

Exactly how much more costly is actually property improvement loan with crappy credit than good credit?

A property improve loan can cost plenty way more if you have bad credit. If you have good credit, funding terminology are usually alot more advantageous and you can help save you tall money.

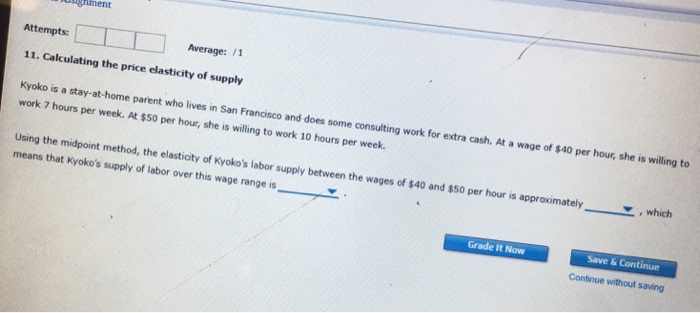

Consider a good $10,000 do-it-yourself mortgage which have four-12 months terms and conditions. Investigate desk less than observe how their borrowing from the bank costs transform based on your own Apr:

It’s obvious how much costly financing with a high Annual percentage rate is. Keep in mind that you’ll save thousands of dollars for the notice compared to saving doing pay money for an effective $10,000 bucks home improvement.

Choosing a property improvement financing that have less than perfect credit

- Wait to hear from your lender. Specific lenders bring immediate approvals, while some usually takes a business day or two supply your a decision.

For 1, no-credit-examine funds usually are riddled having charge. Rates are going to be substantial, also. You to definitely integration helps it be almost impossible to settle your loan as opposed to providing caught up within the a loans stage.