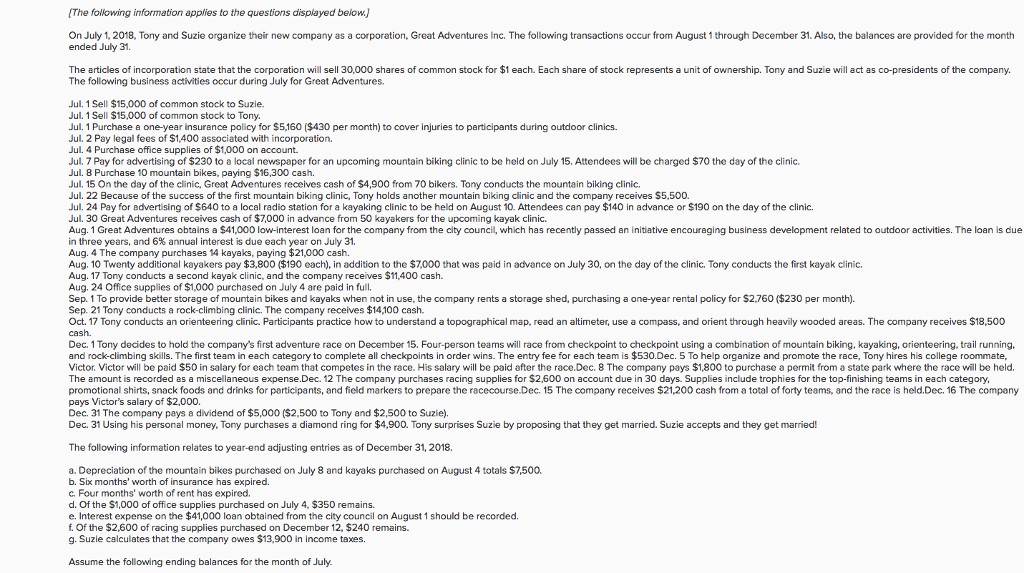

Cash out re-finance against family collateral financing: Similarities

Just how property security financing works

Because the home collateral loans are entirely independent from your financial, the mortgage terms and conditions to suit your new financial will remain unchanged. Immediately after closure your residence security financing, your lender will provide you with a lump sum payment. This lump sum you happen to be anticipated to pay back, commonly on a fixed rate.

To possess a property security loan, its uncommon one a lender makes it possible to borrow 100% of one’s equity. Whilst it varies according to bank, the absolute most that you could borrow is typically ranging from 75% in order to ninety% of value of the house or property.

Particularly a profit-away refinance, extent that one may obtain always utilizes your own borrowing score, your loan-to-value (LTV) proportion, your debt-to-earnings (DTI) proportion, or other activities.

I have browsed the distinctions ranging from a finances-aside re-finance against. a home guarantee loan, now why don’t we look into the parallels.

- Nearly instant currency. You to resemblance between them is you located your bank account very quickly. Regardless if you are taking property security mortgage or an earnings-aside refinance, might receive a lump sum payment in this around three business days after you intimate.

- Borrow on equity. You borrow secured on the fresh security of your house. Which have one another household guarantee funds and cash-aside refinances, you use your property while the collateral. It indicates, as compared to other kinds of funds, you can purchase down interest levels to possess family security money and cash-aside refinances.

- Around 100% security. Generally, you can not take 100% collateral from your home. Really mortgage versions and loan providers stipulate you need to get-off particular collateral regarding assets.

Is it better to features household security or dollars?

Each other household equity loans and money-aside refinances try strategic an effective way to accessibility brand new collateral you have collected of your home. Should it be better to enjoys house equity or cash commonly trust your existing financial predicament as well as your monetary wants.

Opt for the brand new certification criteria to possess often solution. This will help you decide which you to definitely you are apt to be to find acknowledged to possess.

Towards one-hand, a property guarantee financing could be great when you have good good credit rating and want to remove more substantial, fixed lump sum. A profit-out re-finance, simultaneously, may be the smart option if you’d like to decrease your mortgage payment. In addition it allows you to remove funds from the equity of the playing with an individual loan equipment.

Let us take a closer look within if this is so much more beneficial to use a finances-aside refinance against household security mortgage:

When to explore bucks-away re-finance

An earnings-away re-finance may make the most experience for your requirements whether your worth of has increased or if payday loan Montana online you have collected equity over the years by simply making costs. A profit-aside refinance try a decreased-attract way of borrowing the money you would like to possess debt consolidating, renovations, tuition, or other expenditures. Simply put, for those who have big expenses we would like to borrow money to have, cash-aside refinancing are a great way to purchase people expenditures while you are minimizing the attention.

When to have fun with a home security financing

A house collateral mortgage makes sense if the refinancing their mortgage manage force you to score a somewhat highest rate of interest. But keep in mind that this new high interest rate that comes with family guarantee financing might not be beneficial either. It is advisable to calculate in advance to choose in the event the a house equity mortgage makes financial sense for you. By way of example, you will probably find that a house guarantee credit line (HELOC) tends to make alot more sense.