Pick a house and no Money Down from inside the Michigan into the 2024

Top test with respect to to acquire a home for the majority of People in the us is insufficient advance payment. We all know saving to own a down payment can seem to be overwhelming, but at Treadstone, we provide several fund that have low-down percentage selection, and also two that have no downpayment! All of us helps you find the correct program to you making their dreams of homeownership a real possibility.

RD (Outlying Innovation) Financing, also known as USDA Financing, are set aside for number one houses for the rural portion. Certain general standards having RD Loans tend to be:

- Located area of the possessions

- Family money and you can advantage limits

- Family must be the buyer’s number one residence

Virtual assistant Funds is actually set aside for pros and you will energetic responsibility services professionals, because the set from the Service away from Pros Circumstances. Certain general requirements to own Va Money were:

- Legitimate COE (Certificate from Qualifications)

- Family must be the buyer’s number one quarters

Exactly what Michigan Mortgage Software Offer Nothing Money Off?

FHA Money is actually backed by government entities (for example each other USDA and you may Virtual assistant Financing) and are also a beneficial choice with flexible qualification criteria. FHA Funds is actually getting primary houses simply and may even become better-suited for individuals who possess a lower life expectancy credit rating and want borrowing from the bank self-reliance.

Old-fashioned Funds are the most typical mortgage enter in Michigan. Antique Funds also are by far the most versatile sorts of mortgage, and so are useful in some facts. So you can qualify for a low down payment alternative, buyers must fall from inside the income limit set for the particular geographic urban area or be a primary-time family client.

The response to determining your downpayment matter is dependent on yours financial predicament! Homebuyers who would like to facilitate their home buy see a no deposit choice helpful otherwise called for.

Their advance payment number personally impacts multiple areas of your loan- monthly homeloan payment, mortgage insurance policies, and you will restriction approved amount borrowed to mention a few. The Treadstone Mortgage Manager might help determine whether a no off fee financing suits you!

- Conserves extra cash during the lender quick-name

- Might possibly purchase at some point

- Have fun with deals to possess instantaneous solutions, home improvements, otherwise decorating

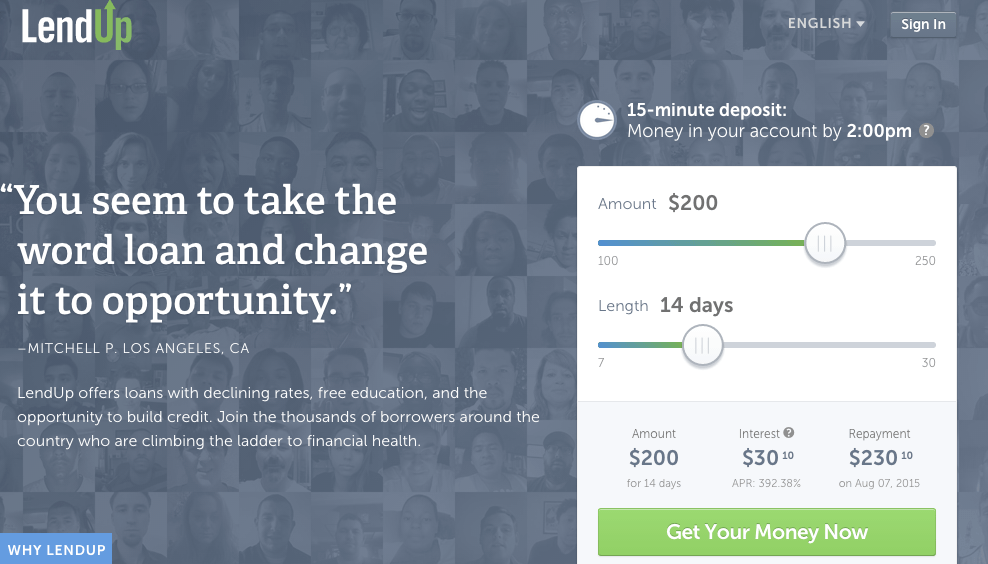

- Zero-down mortgages normally have might have highest interest levels according to the mortgage program

Depending on the Michigan loan program you qualify for, minimal deposit can vary away from 0% to three.5%. The loan Administrator will assist you to determine ideal system to have you! Before this, here are a few more information having very first-date consumers.

What other Resources Exist for Basic-Date Homebuyers?

One of many advantages is the Michigan Very first-Go out Visitors Savings account. It is an income tax-100 % free bank account to own coming residents, such an HSA or 529 studies checking account. The money lead to this lender otherwise broker membership will grow and get protected with no condition taxes due into the the equilibrium or benefits. To find out more, understand our guide to Michigan’s FHSA.

An alternative perk having Michigan home buyers is actually MSHDA, an advance payment guidance program from the Michigan State Casing Innovation Power. Qualified people you can expect to discovered $10,000 from inside the downpayment recommendations fund which can be used to possess closing costs, pre-paids, while the advance payment by itself. MSDHA means a-1% minimal deposit regarding debtor that’s one minute loan on your own home with 0% notice. These types of fund are used for the fresh advance payment and you may/or settlement costs. At exactly the https://paydayloancolorado.net/granby/ same time, MSHDA’s down-payment help is only available on the house charged significantly less than $224,500. To see if your be considered and for info, contact our Michigan Mortgage Officers!

I would like to lay out as little as you’ll; exactly what system is the best for that?

There are several mortgage applications that require virtually no down payments. Get hold of your Loan Officer observe what system you may also be considered to own which meets your needs top. Keep in mind that most of the house orders possess closings will set you back and you can prepaid service will cost you plus the deposit.

The simple answer: it all depends! In the Treadstone, you’re over your credit rating, and you can all of our Loan Officials could work along with you on your own unique situation.

Options are restricted, however, we love to locate innovative. Particular applications can get enables you to purchase the next house or apartment with absolutely nothing money down, however, once the each individual’s condition is unique, there’s absolutely no that-size-suits every. Lose you a line and we’ll create our better to really works something away!