Market frequency try inspired by-interest cost, borrowing availableness, and you can interest in housing

No Ban towards Individual Commission away from Initial Activities and Costs. Part 1403 of your Dodd-Honest Operate includes a part who would are apt to have prohibited people regarding expenses upfront activities or costs on deals the spot where the financing creator settlement try paid by the a guy aside from the fresh consumer (possibly to the creditor’s very own staff or to a large financial company). But not, the latest Dodd-Frank Work including authorizes the brand new Agency to help you waive otherwise perform exemptions on prohibition towards initial affairs and you will charge. The fresh Agency registered to provide a complete different towards the ban to the initial points and you can charges on Bureau’s Laws and regulations, detailing that the Agency needed seriously to have a look at the latest perception such as for instance a good prohibition will have on the mortgage industry.

B. The market

The latest Agency monitors the loan origination markets included in their supervision and you will enforcement of TILA and you may Regulation Z, such as the home loan origination legislation that will be the topic of so it review, along with other aspects of brand new controls relevant into the business and you will using supervision of your Safer Operate and A home Payment Procedures Work from inside the Guidelines Grams, H and you can X, respectively.

1. Markets Structure and you can People

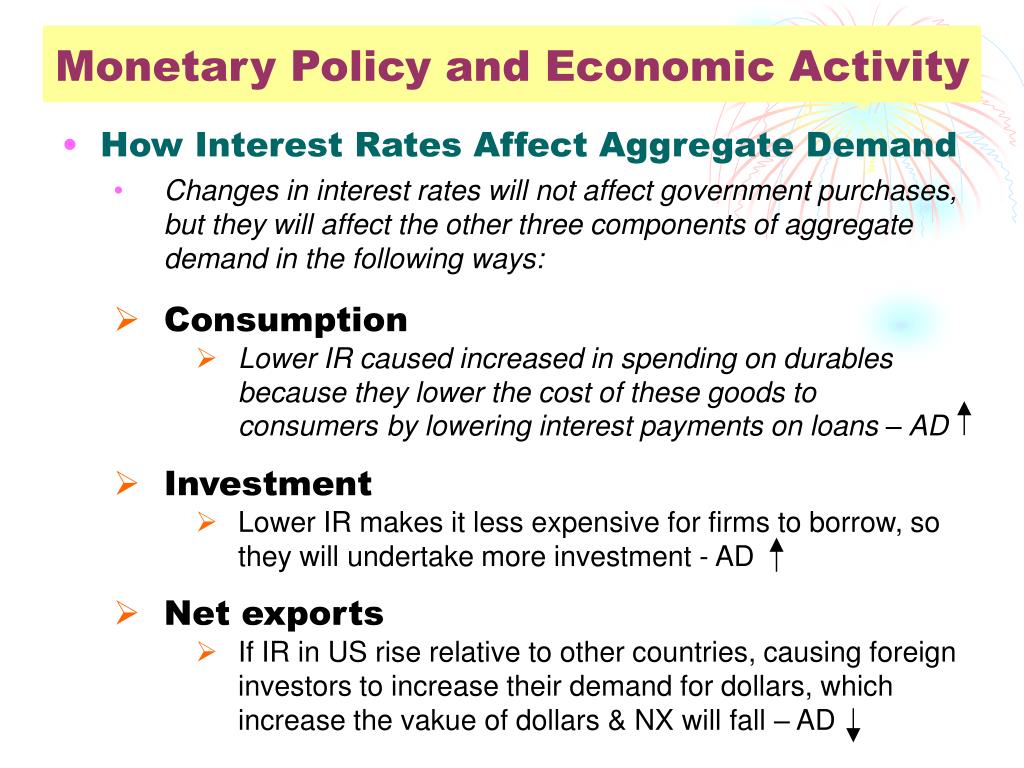

The borrowed funds origination marketplace is among the many Joined States’ premier consumer monetary markets, having an average estimated annual origination quantity of from the ten billion mortgage loans ( printing webpage 16202) having $2.dos trillion for the past ten years. The market industry had been expanding recently because of the really measures up to a sharp lag taking place into the 2022 on the fast raise inside mortgage cost. Throughout attacks out-of apparently low interest, interest in mortgage loans can be strong while the to shop for electricity try good ( we.elizabeth., brand new monthly cost of a home loan relative to the borrowed funds balance is actually low). When interest levels improve, to shop for electricity was smaller and therefore demand weakens. However, whenever rates of interest decrease, to purchase strength try improved, driving enhanced mortgage consult. Coming down interest rates also push interest in refinances separate on the interest in domestic sales. This leads to highest spikes inside the financial origination request shortly after higher drops when you look at the rates, as the is actually seen in 2020 and you can 2021, with quick reduction in request when interest rates increase, as the try seen in 2022. The availability of borrowing from the bank together with has an effect on demand for mortgages. Because the credit availability is actually alleviated, the capacity to obtain financial financing try relaxed, permitting far more prospective buyers to access financial credit, and thus growing request. Alternatively, an effective toning within the borrowing from the bank supply tend to restrict usage of mortgage resource which reduce consult. These results of borrowing from the bank accessibility on the market were very noticable in the lead up to the favorable Market meltdown of 2007-2009, in which lax credit underwriting conditions contributed to popular to possess household instructions although rates started to increase. Subsequently, new crash throughout the value of owned property and mortgage sector contributed to big toning of credit criteria and you will dampening request to have home ownership although rates of interest pay day loans Spanish Fort AL denied.

Involvement on the market is actually diverse, ranging from the greatest finance companies in order to brief society banking companies, borrowing unions, and you may low-depository lending establishments. Contribution by higher banking institutions provides refused over the past a decade because the highest low-depository loan providers emerged as pri, 11 of your most readily useful 25 loan providers were depository associations, whilst in 2021 just half dozen of one’s best 25 were depository organizations. And the development towards home loan financing by the non-depository establishments, the market has experienced integration according to the participation out of highest creditors. In 2014, the big 25 loan providers portrayed 34 % of the top twenty-five portrayed forty-two percent.

All Statutes apply to institutions one participate in originating otherwise stretching closed-prevent, consumer credit purchases secure by a home. For this reason, all quick organizations that originate or extend closed-prevent credit rating transactions protected of the a dwelling, such as depository organizations and you can non-depository associations, including mortgage brokers, are likely susceptible to about certain areas of the principles.