How does property Security Loan Operate in Nj-new jersey?

Taking out a property collateral financing allows home owners to gain access to tappable domestic security in the way of financing. You can get the bucks you want to possess everything from family home improvements to college expenses.

Griffin Financing allows you to acquire household guarantee funds that have aggressive cost and you will an easy online software. See how you could benefit from making an application for a property equity mortgage in New jersey.

House guarantee funds is actually secured finance that use their residence’s guarantee once the collateral. You might sign up for a home equity loan according to the collateral plus the worth of your residence, and you can have fun with that cash to own anything you require.

While the house guarantee financing was secured loans, family collateral mortgage prices from inside the New jersey are typically below borrowing from the bank cards and personal funds. If perhaps you were thinking of using a charge card to possess home improvements or scientific expenses, property security mortgage is generally a much better option. The brand new comparably low interest rates out of home equity finance along with build all of them good debt consolidation solution for these that have bank card personal debt or other higher interest bills.

As soon as we agree you for a house equity mortgage, we enables you to make use of a specific percentage of the residence’s equity. Lenders normally allow you to borrow sometimes 80 to 95 % of your security you’ve got of your house. You’ll be able to either keeps place mark and you can installment attacks which have a HELOC or a fixed loan period with good HELOAN. If you opt to sell your residence before you’ve completed investing away from the loan, the money you owe can come from the money you produced from attempting to sell your residence.

Nj-new jersey home security funds generally speaking need you to submit tax efficiency when using, but that’s never possible. We offer a bank report HELOAN for folks who can not offer W-2s.

Type of Household Collateral Finance

Whilst each and every domestic guarantee loan is sooner equivalent, there are key differences when considering a classic family collateral financing (HELOAN) and you may property collateral credit line (HELOC).

A traditional domestic equity mortgage can be like some other fixed-rate financing you’ll sign up for. Should you get acknowledged, you are getting a lump sum just after. Your own financial also give you a predetermined interest rate and you will a set financing title, which means that your payment per month is the exact same up to your mortgage is paid off. Family security loan costs during the New jersey can vary off mortgage to financing, but your rates won’t changes.

A property guarantee personal line of credit is a bit different. Which have an excellent HELOC, you utilize the latest equity in your home to ascertain a line from borrowing with a lender. The financial gives you a paying limitation based on how far your home is worth and exactly how much collateral you have. HELOC rates when you look at the Nj-new jersey is actually variable, so your rate of interest can go up or down predicated on markets requirements. HELOC cost in Nj also are partially according to their creditworthiness and strength as a borrower.

Both sort of domestic guarantee funds possess positives and negatives, therefore think about what you happen to be using your money having and you may and that mortgage style of might be finest designed for your circumstances.

Advantages and disadvantages of brand new Jersey Household Equity Finance

And come up with informed conclusion is actually a button part of becoming a sensible debtor, and therefore begins with understanding the advantages and you may hazards of Nj domestic security funds. Before you apply having a house equity loan when you look at the New jersey, this is what you have to know.

- You can access money that can be used having anything

- You are able to keep your reduced mortgage rates even although you become approved for a financial loan

- Griffin Resource offers aggressive domestic security financing rates for the Nj-new jersey

- Attract toward household security fund will likely be tax-deductible in some times

- You can use HELOANs in order to utilize the newest security on the no. 1 household, vacation family, otherwise money spent

- Taking right out a property security financing expands your total personal debt

- It may be tempting so you can overspend which have an effective HELOC

- You could potentially clean out your property if you can’t repay their financing

When you are domestic guarantee loans would be of use, they do incorporate threats. Check the options and make sure you are aware what you’re bringing on the prior to taking aside a house collateral financing in The Jersey.

Nj-new jersey Home Security Mortgage Certification Conditions

Knowledge home equity mortgage criteria can help you become approved the very first time your apply. How does a home security financing really works regarding choosing just who qualifies? This is what you should know:

- Lenders enjoys a set lowest quantity of home collateral you must want to get recognized for a loan. Specific loan providers wanted 15 percent lowest guarantee, but 20 percent try most frequent. At the conclusion of the day, you’ll need to retain five so you can 15 per cent regarding their equity immediately after getting the cash of a HELOAN.

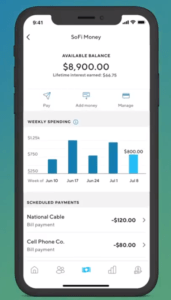

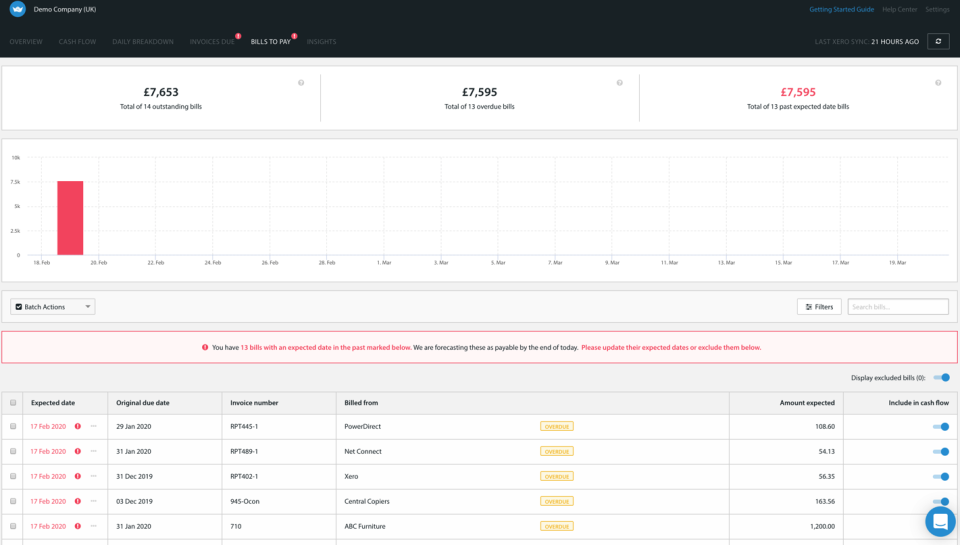

New jersey domestic guarantee loan conditions are very quick, but it’s less simple as with guarantee in your home. If you’re getting ready to apply for investment, you are able to new Griffin Gold software to bolster your financial reputation, display the using and you will credit, contrast financing choices, and also individualized help from financial masters. Griffin Gold makes it simple to monitor your bank account in one simple app.

Submit an application for a property Equity Financing inside the Nj-new jersey

Many reasons exist to consider taking out a house equity loan. Reduced home security mortgage pricing in Nj-new jersey allow you to increase income and you may shelter huge costs

Would you like money to possess home home improvements or surprise major costs? Griffin Financing will be here to simply help. At the Griffin Capital, you can expect many funding products, in order to discover a solution that fits your circumstances. If you want to learn more about Nj house equity money or get financing, complete an internet software or contact us today.