Exactly how much Is Household Collateral Loan or HELOC Closing costs?

Closing costs with the a home security loan or home collateral range away from borrowing from the bank ranges out-of 2% to help you 5% of loan amount otherwise credit line. not, you will find some loan providers that won’t fees settlement costs after all.

In this post:

- Exactly what are Settlement costs?

- How to prevent Closing costs into a home Equity Loan otherwise HELOC

Home guarantee finance and you will household security personal lines of credit (HELOCs) have a tendency to charge settlement costs, whether or not it’s possible to receive each other with out them. Towards loans and you can lines of credit that do include closing costs, you can expect to pay ranging from 2% and you can 5% of loan amount, with respect to the bank.

Some tips about what you must know about how precisely settlement costs performs towards the a property security financing otherwise HELOC and ways to stop them.

What are Closing costs?

Family equity loans and HELOCs really works in different ways, however, one another allow you to borrow secured on the fresh new collateral you’ve got of your property, and additionally they one another hold some of the same settlement costs.

These will cost you, some of which are like financial closing costs, are generally energized when you close your loan. Although not, the sorts of charges you might be charged in addition to number can differ because of the financial. Below are a few of the charge to look out for given that your examine different options:

- Origination commission: This percentage is billed to afford lender’s cost of originating the loan or personal line of credit. It may be a flat fee otherwise a share of one’s amount borrowed or credit line.

- Assessment fee: So it payment will cost you $349 on average americash loans locations Aurora, predicated on HomeAdvisor, and that’s paid down to help you a specialist appraiser just who will bring an assessment of residence’s well worth.

- Credit history payment: It fee ranges from $31 in order to $fifty, and lenders costs they to pay for cost of checking the borrowing from the bank when you implement.

- Term research fee: The cost vary away from $75 in order to $200, according to where you happen to live. Loan providers work on a concept search with the intention that there are not any almost every other liens otherwise says to the property.

- File thinking costs: Lawyer are often used to prepare yourself the newest data for the mortgage or line of credit, as well as their costs may vary considering where you live.

- Mortgage tape percentage: Your own state recorder or any other regional official usually normally charges good $15 in order to $50 fee to afford cost of recording the lien on your own house from the societal list.

- Notary payment: Particular loan providers may charge a supplementary percentage regarding $fifty so you’re able to $200 for an excellent notary social verify and you will notarize your loan data.

Likewise, particular HELOCs may charge a continuous yearly payment, a deal payment every time you bring a suck out of your line of credit plus a sedentary lifestyle fee or even play with the brand new line of credit usually adequate. All of these charges can differ, so it is important to investigate fine print to have correct evaluation.

How to prevent Closing costs toward property Guarantee Mortgage or HELOC

According to your position, discover a couple different ways you could potentially avoid settlement costs on your own family collateral financing otherwise HELOC, or at least buy them less:

The important thing is that you take care to look all solutions before applying so you’re able to optimize your coupons. Since you examine also offers, definitely weighing initial will set you back against long-label expenses.

Like, if an individual HELOC fees $500 quicker in conclusion will cost you than another type of however, has a good $100 annual percentage given that second item has actually none, you may be better off towards the 2nd alternatives for people who decide to make use of the HELOC for over 5 years. As you run the brand new numbers and you can utilize almost every other mortgage selection, you should have a less complicated date choosing the best one for you.

Build your Borrowing from the bank to optimize The Offers

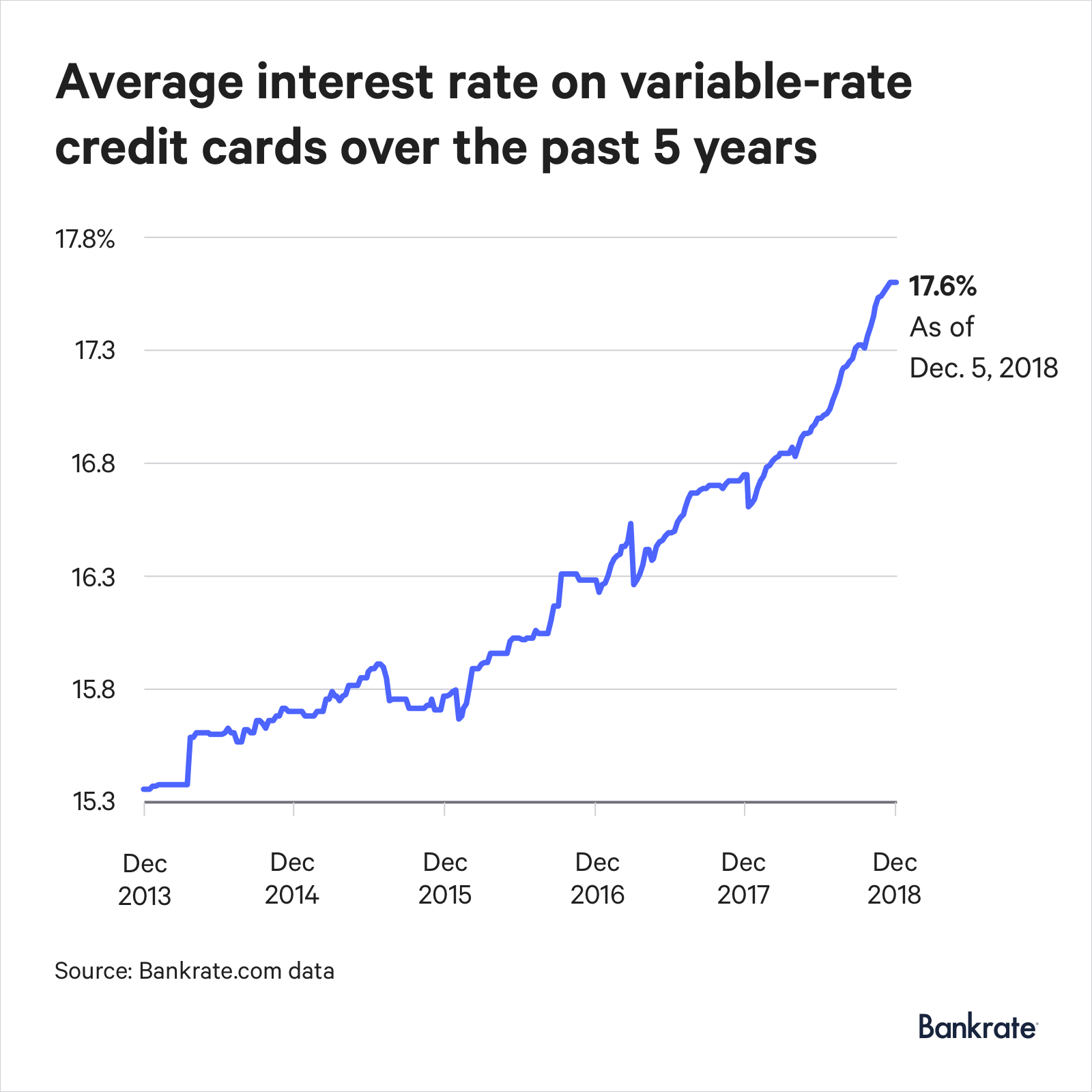

That have good credit won’t always reduce your settlement costs, nevertheless helps you qualify for greatest rates to the property security mortgage otherwise HELOC. A lesser interest rate could easily save you a whole lot more over the long term than just down initial will set you back.

Begin by checking your credit score and you can credit file having Experian to assess the health of your own credit file, then concentrate on the components that want specific work to improve their borrowing from the bank. This might is paying down the credit card balance, paying collection membership, and come up with all costs promptly in the years ahead and you may making certain all the information on your credit report was direct.

Dependent on your position, this course of action takes big date, but if you don’t have to acquire instantly, the hassle can pay away from eventually.