Is actually Household Examination Needed for a traditional Mortgage?

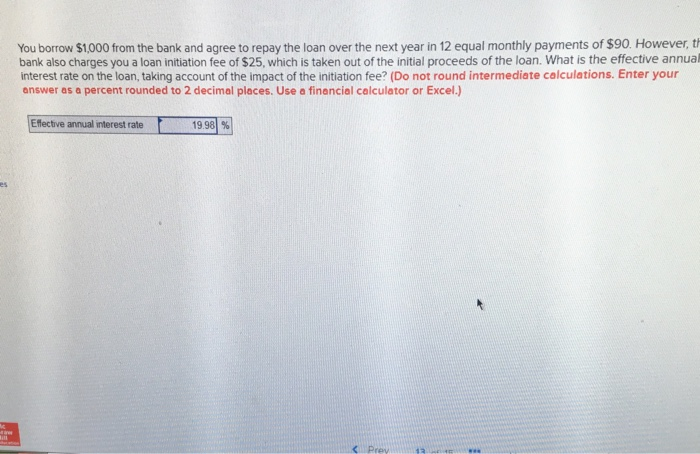

To order property is a huge money that really needs consideration. As a buyer, you can also wonder whether or not a normal loan need a home assessment. Knowing the basics from home inspections in addition to their effect on the fresh buying procedure is very important while making an informed decision. A thorough investigations of your county of a home accomplished by the a specialist inspector was referred. They check all of the solutions, together with electric, plumbing system, and you may Cooling and heating, therefore the full build and protection of the home. That it assessment brings worthwhile insight into potential property situations and assists customers create a knowledgeable choice.

Property check may not be necessary for traditional mortgage brokers inside the Tx and you can California. Yet not, you should keep in mind that a home appraisal try compulsory. An offer analyzes new property’s overall worthy of and you may reputation but could maybe not determine all potential things. Guess you’re considering a conventional loan for the Ca . Therefore, it is very important to recognize anywhere between property assessment and you will an review and make a proper-advised choice in the to find.

Why Rating property Inspection Complete Before buying?

A house check was an easy way to influence the issue just before you order they. It gives a thorough report about the state of the major options and you will section, like the roof, base, plumbing work, electrical, Cooling and heating, and appliances.

Select Dilemmas

New inspector will for the possible problems with the property, and they’ll search for leaks, cracks, or any other conditions that can result in wreck or be pricey. It helps your prevent any surprises and give you a great better concept of what you’re entering.

Discuss The purchase price

Negotiating a discounted price into supplier is possible whenever they tell you any issues. In the event that, including, new inspector finds out that the rooftop must be replaced, you’ll be able to request your provider lowers the price or resolve the top till the residence is finalized.

Cover Disregard the

To order a property try a substantial financial commitment, and confirming that you’re finding a fair worth to suit your resource is important. Capable bring assurance which help ensure you are not purchasing a house demanding costly solutions in the near future.

Arrange for Upcoming Repairs

While the home may well not introduce reasonable questions, it does still render valuable details about the newest property’s standing. It assists you want having coming repairs and repairs thus as possible budget correctly.

Safety first

However they help pick one protection danger into the assets. Eg, the brand new inspector may find the fresh electronic program dated otherwise asbestos otherwise lead-oriented painting. Knowing these types of threats can help you decide if the home is really worth the possible health risks.

House Review Standards To have Conventional Home loans:

Understanding the required conditions is important if you are planning to acquire a traditional financial. Which test assesses the condition of the latest residence’s big options, parts, and you can investment really worth. Simultaneously, a property review is necessary to identify one conditions that can get affect the residence’s worth or angle a safety risk towards the residents. In Texas, traditional mortgage criteria become a thorough check to make sure compliance having credit standards so that mortgage brokers would not make any situations. Please don’t forget about this very important part of the to buy techniques, because it can save you out of potential fears and you may economic losings eventually.

What is actually Generally speaking Included in property Evaluation For a traditional Financing?

A thorough assets examination is essential to determine possible products affecting its worthy of otherwise cover. The fresh new inspector explores the complete property, all the way through, for instance the roof, base, walls, and you may floor. However they measure the reputation of the plumbing work, electrical, and Cooling and heating solutions and any additional provides within the possessions. The most important thing getting antique mortgage inspections, in which the property need certainly to satisfy specific conditions to be eligible for the fresh new financial . Trust our expert examination qualities to make sure your house is inside top shape.

So what does The fresh Inspector Pick During the Assessment?

Within the inspection, new inspector will your signs of destroy, wear, and you will split, or other affairs. They are going to use various gadgets and methods to evaluate the fresh property’s reputation, including:

- Artwork Assessment: They visually look at the house for all the signs and symptoms of ruin otherwise wear and tear, and they’re going to find splits, leaks, or other things.

- Testing: The fresh inspector may take to new plumbing work of the powering h2o and you can examining to own leakages, and so they may also shot the brand new electricity program by checking outlets and switches.

- Measurement: The inspector may use some gadgets determine the fresh new property’s reputation, eg a dampness meter to check on to own water damage.

- Papers : They are going to document its results in a report offered to new customer.

What will happen in the event that an enthusiastic Inspector Finds Anything Concerning the During your Home Evaluation?

no credit check payday loans in Lakeside Colorado

If the an enthusiastic inspector finds out something concerning the during your family examination, it is critical to assess the severity of issue. In case it is a minor point, the inspector may advise that your treat it later on. However, guess it is a life threatening topic, for example a protective possibilities or a structural condition. Therefore, the latest inspector will likely recommend that you treat it before proceeding to your house get. It is vital to make inspector’s findings certainly and also to focus on their realtor together with merchant to decide an educated action to take. If required, it is possible to should talk to a professional contractor otherwise engineer to learn ideal the trouble and you can potential solutions otherwise can cost you inside it.

Achievement

A house evaluation before purchasing is an important step up to acquire. It helps your prevent high priced surprises later, negotiate a far greater handle the vendor, and ensure which you create a knowledgeable decision concerning the possessions. It is typically called for should you get a traditional mortgage, and they’ll discover various dilemmas. In the event the inspector discovers anything towards, several options come, also discussing repairs or credits to the provider or walking away in the deal totally.

Translend Financial is actually a home loan seller for the market’s most acceptable cost and will set you back. Our very own home loans will help you within the locating the best mortgage that provides lenders for folks who want to make their imagine owning a home come true.