Your own Help guide to Investing Credit card debt which have a house Collateral Financing

With regards to repaying personal credit card debt, compounding interest rates helps make fees feel like a constant competition. When you are a good Canadian homeowner trying to get from under your credit debt, you are entitled to fool around with a property collateral financing in order to pay your debts.

Try a house equity financing the best choice for your requirements? Inside publication, i security the basics of paying down personal debt which have a home security financing therefore the relevant benefits and dangers.

Paying off Credit card debt having a house Guarantee Financing: Experts and you may Dangers

Before deciding to get a property security loan, it is crucial to adopt the advantages and you can risks you may also sustain.

The benefits of a house Collateral Financing

A house security mortgage is somewhat benefit homeowners struggling to pay-off their bank card expense. Here are some of your biggest gurus:

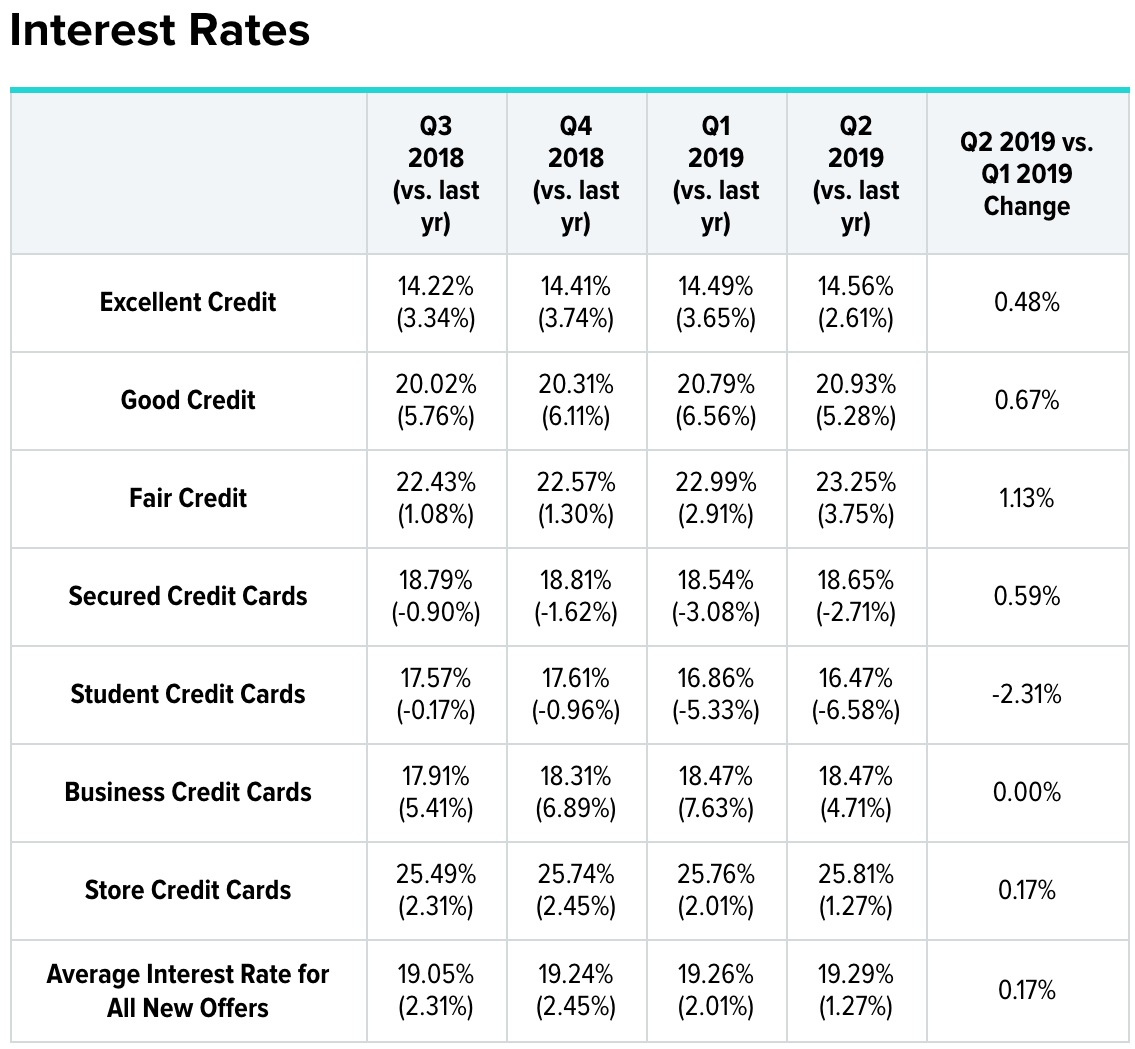

- Straight down Interest rate: once you pay-off the personal credit card debt that have property equity mortgage, your effortlessly decrease your interest. An average household guarantee interest rate is but one-4th of one’s mediocre bank card interest rate. Reducing your interest can cost you could save you plenty on the much time work on.

- Debt consolidation reduction: for those who have multiple handmade cards that need to be repaid, a home security mortgage enables you to pay them all out-of immediately. After that payment, you are going to combine your own monthly loans repayments of multiple private cards repayments towards one to family collateral financing fee. Merging the debt may also after that lower your focus.

The dangers off a home Equity Financing

When you are property security financing will likely be perfect for you, it is very crucial that you take into account the threats before making an effective decision. Listed below are some potential disadvantages:

- Your property once the Collateral: the largest drawback away from a home collateral mortgage is that your home is put just like the guarantee-if you fail to repay the primary amount when you look at the given months, your risk losing your home. Yet not, for individuals who approach the loan realistically and you may funds your repayments to come of your time, the chances of so it taking place are lower.

- You are able to Gather Much more Obligations: if you’re a home equity mortgage shall be a great way to pay-off their credit card bills, you will need to consider carefully your current financial situation. If you are not confident in your capability to settle their household equity financing, you will probably find on your own much more loans than in the past.

Options to help you Paying down The Personal credit card debt

If property security loan does not seem like ideal complement you, you will find several other choices you can test. Listed below are some solution a method to pay off your own borrowing credit financial obligation:

Change to a lesser-Attention Credit card

The largest hurdle when paying personal credit card debt ‘s the increasing price of combined desire. Focus towards the charge card payments, specifically late payments, substance and certainly will quickly spiral out of hand.

Fortunately, of numerous credit card companies offer advertisements for brand new members that will lower your notice expenses. You will be able to transfer all your costs to a good the fresh charge card you to definitely charge 0% attention to your first year . 5. While you are going your debt to another cards will not create online payday loans in Peetz it drop off, it will leave you additional time to catch abreast of your payments without paying nice interest fees.

Do a cost Package

The earlier you pay your own personal credit card debt, more currency you save. After all, you can’t feel charged desire on that loan that was totally reduced. For folks who simply result in the minimal needed monthly installments, it entails a lifetime to pay off the obligations entirely. We recommend that your finances your income to spend from as much of one’s bank card costs as you possibly can, as fast as you can.

Borrow funds From your RRSP

When you yourself have high money on the Joined Senior years Deals Bundle (RRSP), you may be tempted to withdraw that cash to assist spend off your own mastercard expenses. While this will likely be advisable if you don’t must place your house up since guarantee, withdrawing from the RRSP does incorporate several setbacks.

If you’re withdrawing from your own RRSP, and is also never to get your first domestic otherwise funds your own degree, you will be subject to a great withholding income tax upon detachment as the better while the a supplementary tax. Even with such restrictions, settling your debt is commonly really worth the extra expense.

Query the professionals

When you are enduring the selection between a property collateral mortgage otherwise a choice route, Clover Mortgage can help. We was specialized in debt consolidation reduction fund and has now supply to an enormous community of over 50 additional loan providers. We can help you discuss the options and find out if the a property security financing is right for you.