Significantly less than Babcock’s influence, the fresh new FHA wrote their basic Underwriting Tips guide in 1935 to determine which homebuyers entitled to FHA-covered funds

How FHA Minimal Lending because of the Location

Shortly after Roosevelt’s The fresh new Deal revealed the new HOLC, the guy finalized the fresh new Federal Housing Act when you look at the 1934, and that created an additional institution that also reshaped mortgage money, known as Federal Property Government (FHA). FHA signaled a primary step into totally free markets by using social tax bucks to help you subsidize financial risks one to generally speaking fell to privately-had finance companies or any other financial institutions, included in the The fresh new Offer administration’s overall propose to reconstruct the brand new shattered housing industry.

The FHA’s concept of risks regarding housing marketplace mirrored the newest racial views from Frederick Yards. Babcock, Movie director out-of Underwriting, and you can other officials at that government institution. Students suggest Babcock because the first in order to codify how realtor industry would be to factor race into the their authoritative tests out of possessions thinking. To start with out of Chi town, the guy graduated out of Northwestern University, has worked in his father’s home firm, upcoming typed 1st book, New Appraisal away from A home, into the 1924. Babcock observed one residential philosophy are affected by racial and you can spiritual products… A house energy tries place close people, however, constantly close individuals of the identical social status, same events… He delved subsequent into that it theme of socially homogenous communities whenever writing their influential book, The new Valuation away from A home within the 1932. When you look at the a part named The fresh new Determine out of Public and you can Racial Facts, Babcock asserted that many people transform simply bring about gradual variations in value of, discover one to difference between someone, namely competition, that can end up in an extremely quick decline. Fast refuses in the property viewpoints is partly prevented by segregation, Babcock contended, and you can recommended one Southern methods for splitting up Whites and Blacks you’ll also be suitable in the Northern claims. 31

Contour 2.8: Frederick Meters. Babcock, found right here since Manager of your own Underwriting Division of the Federal Construction Administration during the 1937, codified how presence regarding inharmonious racial communities would be negatively factored on the FHA home loan software. Pictures digitized from the Collection of Congress.

Just like the HOLC truly given mortgages to help you current people to help save all of them out-of bank property foreclosure, the brand new FHA dealt actually that have banking institutions or any other lenders, and you will given a kind of insurance policies-called underwriting-the spot where the federal government guaranteed you to definitely homebuyer mortgages might be paid back

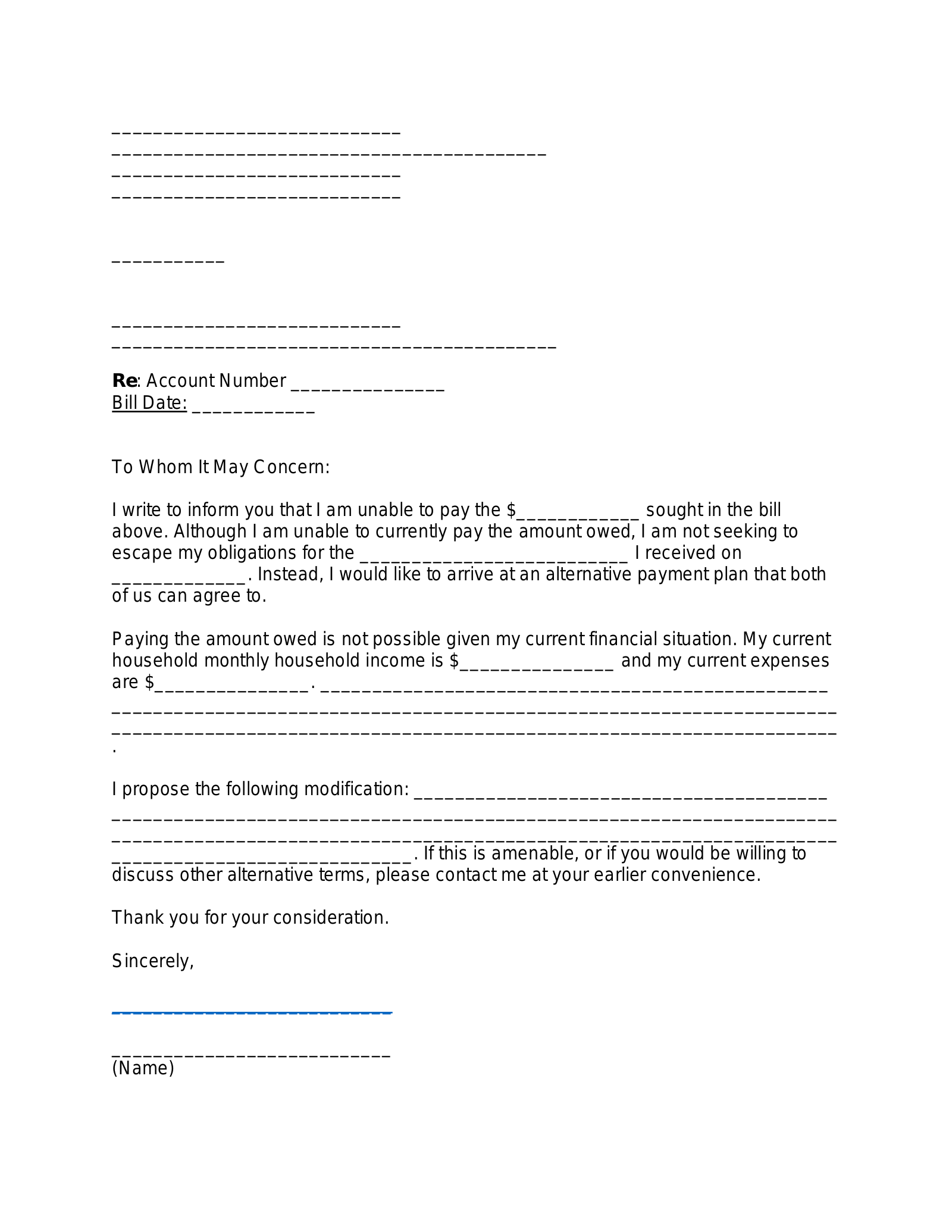

It detail by detail 200+ webpage tips guide, and this became lengthened with subsequent editions, mainly based guidelines having FHA group so you can speed financial programs. Information given how FHA evaluators is to search the home, take a look at the venue, and legal the applicant’s credit worthiness in advance of giving bodies funds in order to underwrite the borrowed funds and be certain that fees. The newest Guidelines seemed decide to try rating maps one summarized certain situations to own FHA evaluators to consider, for instance the ratio of your financing on worth of the house, additionally the probability the strengthening might have financial worthy of beyond living of the home loan, because found in the Shape 2.9. Nevertheless the very first thing towards the setting is Area. Even if the app gotten highest marks https://speedycashloan.net/installment-loans-or/ various other kinds, a negative venue score called for FHA professionals so you can reject they. 31

Figure 2.9: So it decide to try rating graph from the 1936 Government Homes Government Underwriting Guidelines demonstrated how an undesirable place get called for FHA team to reject home financing app. Provider managed of the HathiTrust.

Exactly how performed the fresh FHA Underwriting Guide determine a great venue? One particular greatly-weighted basis is Protection from Adverse Influences, hence regarded different methods to defend homogenous White middle-classification residential district areas out of outsiders it considered undesirable. FHA sent appraisers so you’re able to always check besides the new real building, but in addition the personal class of its surroundings and coming threats in order to its stability. The fresh new Manual instructed appraisers so you’re able to read the components close the region to choose even when incompatible racial and you may personal groups can be found, like Black, immigrant, otherwise straight down-earnings customers, since the people intrusions perform induce imbalance and you will a decrease in values, because shown within the Figure dos.10. Areas obtained higher results whenever they had been protected by pure otherwise artificially centered barriers, such mountains, parks, freeways, or college campuses one eliminated infiltration by the lower-classification occupancy and you can inharmonious racial communities. The new Manual as well as best courtroom units one to racially and you can economically segregated neighborhoods- like racially restrictive covenants and you will exclusionary zoning ordinances-because the explained in afterwards chapters in this guide. FHA direction together with formed regional informative rules of the cautioning that community universities really should not be went to within the signifigant amounts from the inharmonious racial communities, and so leverage government construction finance to help you stop included universities. Fundamentally, brand new Manual warned appraisers to carefully think possible alterations in coming age, as if the fresh new reputation off a neighbor hood refuses, it certainly is impractical to cause a top personal class than simply people already in the community to acquire and you can reside attributes. Complete, tax-served FHA mortgage loans divested federal money from existing land in racially and you may economically diverse area communities, when you are funneling currency to your new house construction in all-Light suburbs. thirty two